Yes, Virginia – Creditors do sometimes get a vote …

More on:

This is Brad Setser again. Thanks to Christian Menegatti and Rachel Ziemba for filling in when I was away. It is only fitting to return with one of my pet themes: central bank demand -- or rather, the current lack of central bank demand -- for Agencies.

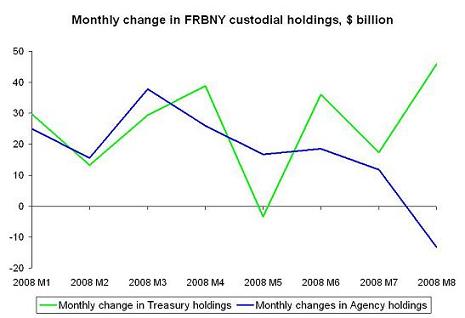

In August, central banks added close to $46 billion ($45.92b) to their custodial holdings of Treasuries at the New York Fed. In August, they reduced their holdings of Agencies by a bit over $13 billion ($13.33b).

A chart showing the monthly change (using the end of period data rather than the weekly average, and taking the weekly period closest to month end as a proxy for the end of the month) shows the recent change clearly.

No wonder that the options market is now implies a significant probability that the Agencies existing common equity will be worth zero; look at this chart produced by Paul Swartz, a colleague of mine at the Center for Geoeconomic Studies.

If these trends continue for much longer, US Treasury Secretary Paulson will be forced to show his hand. The Agencies won’t be able to rollover their debt -- at least not at a spread that works for them. The US government will then either have to step or let the Agencies fail. And, well, letting the Agencies fail, in the sense of default on their debt, is probably more than the US government is willing to consider right now. Any restructuring though would likely be bad for the holders of the Agencies common equity.

Dan Drezner argues – in a recent paper on sovereign wealth funds – that the importers of capital can still set the rules of the game.* He draws an analogy to the fact that larger consumer markets often set global norms in a host of markets for goods and services. In this case, the US -- as a consumer of savings -- has the market leverage, not the producers of savings.

Drezner is at least partially right, though I rather doubt the good practices that sovereign wealth funds are currently trying to hammer out will amount to much. Big emerging economies cannot easily limit their financing of the US without making dramatic policy changes at home. There really aren’t that many places that can absorb the huge surpluses China and the oil exporters are now generating. They do need places to invest.

In this case, though, the world’s central banks have a fairly clear alternative to buying Agencies: buying Treasuries. Shifting from Treasuries to Agencies cost them a few basis points, but it didn’t require a wholesale change in the currency regimes. It doesn’t require any big policy decision on their part. It is just a technical decision about reserve management – and probably a prudent one at that.

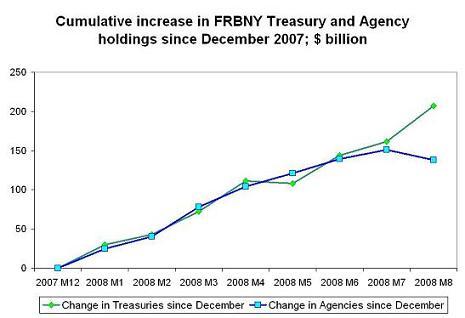

A chart showing the cumulative increase in the Fed’s custodial accounts since the end of December show this change almost as well as the chart showing the monthly changes.

The impact of such a shift, by contrast on the US is far more pronounced. Without central bank financing, the Agencies cannot exist in their current form. They certainly cannot be a conduit between the large pools of savings in the hands of emerging market governments and the US housing market. And right now, that is exactly what the US government wants them to do. Private demand for mortgages – and most other forms of household receivables – has dried up. The Agencies are the mortgage market.

Now, if the US could credibly threaten to allow the Agencies to fail – and by fail, I mean default on their debt, not their equity – the story would be a bit different. Foreign central banks would be faced with a true collective action problem. They all would prefer that everyone add to their Agency holdings, allowing the Agencies to refinance their maturing debt – and all their creditors to avoid taking losses. At least for now. Deferring losses isn’t the same as avoiding losses. Each individual central bank though would rather some other central bank take the risk of holding Agency debt.

This, of course, is analogous to the situation the world’s central banks face with respect to the dollar: if they don’t keep adding to their dollar holdings, the value of their existing dollar holdings will fall. Barry Eichengreen argued back in 2004 this meant that every central bank had an incentive to get out of the dollar. That obviously hasn’t happened.

In large part because of dollar pegs – and because diversifying out of the dollar is probably difficult if you peg to the dollar, and not pegging to the dollar has generally meant allowing your currency to appreciate against China not just the US. And that is costly.

And while central banks seem to have stopped buying Agencies, they certainly haven’t stopped buying dollars. Over the first 8 months of 2008, central banks have added an average of $43.14 billion to their custodial holdings at the New York Fed. Annualized, that works out to a pace of over $500 billion. That far exceeds the pace of early 2004, back at the peak of Japanese intervention.

The Fed’s custodial accounts don’t tell the whole story either. My guess is that most of the large oil exporters don’t make heavy use of the Fed’s custodial services. The Fed’s data consequently leaves out a lot of money. The increase in central bank and sovereign fund holdings outside the Fed’s custodial accounts – in my judgment – is about equal to the observed increase in the custodial holdings.

In some sense though that doesn’t matter.

Central banks don’t have to stop financing the US to have a bit of influence over US markets. The scale of central bank purchases is now so large that all they need to do is shift from buying one asset to buying another ...

Call it a buyers strike by central banks on assets other than Treasuries.

*An aside: Back in the 1990s, the US didn’t exactly think that Argentina and Brazil got to set the rules just because they were importing large amounts of capital …

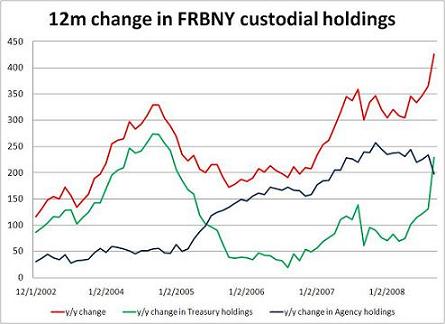

UPDATE. With Paul Swartz’s help, I was able to get the monthly data on the FRBNY’s custodial holdings back to 2001. The 12m change in FRBNY holdings -- broken down into the increase in Treasuries and the increase in Agencies -- makes for an interesting picture.

More on:

Online Store

Online Store