Tax Games: Big Pharma Versus Big Tech

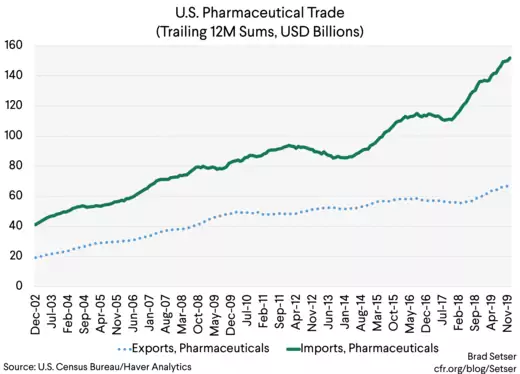

American pharmaceutical companies are skilled at using transfer pricing to shift the profit on their U.S. sales out of the United States. That is why the United States' trade deficit in pharmaceuticals is now bigger than the United States' trade surplus in aircraft.

February 12, 2020 4:36 pm (EST)

- Post

- Blog posts represent the views of CFR fellows and staff and not those of CFR, which takes no institutional positions.

The tax avoidance strategies of large American pharmaceutical companies and the big American technology firms differ just a bit.

Technology firms generally pay U.S. corporate income tax on their U.S. profits. Their basic tax game has been to shift—through research and development cost shares and underpricing the “sale” of their intangible assets to their subsidiaries—their global profits to low or no tax jurisdictions. That at least is the conclusion I draw from the amazing work of the Senate investigative committee. I wish that Apple’s global tax strategy was as widely understood as the global nature of its supply chain.

More on:

Pharmaceutical firms are in a sense more aggressive in their tax strategies (see my testimony before the House Ways and Means Committee). The United States, thanks to pharmaceutical prices that are systematically higher than in other advanced economies, is by far the most profitable market for most pharmaceutical companies. So many pharmaceutical firms, through transfer pricing games, often try (and often succeed) to shift a portion of their U.S. profit to a low tax jurisdiction. We know this because the U.S. headquarters of some major pharmaceutical firms have long run losses—losses that sometimes had to be covered (pre-tax reform) by dividend payments from their very profitable offshore subsidiaries back to their parent. The U.S. headquarters could also borrow against its offshore subsidiaries financial assets.

The stylized tax strategy of many pharmaceutical firms could be simplified to something like this:

1. Identify a valuable drug by testing it in the United States market;

2. Transfer the right to exploit the pharmaceutical product to a subsidiary in a low or no tax jurisdiction like Bermuda;

3. Set up a manufacturing subsidiary in another low tax jurisdiction (Ireland, Singapore, and Switzerland are common—but Puerto Rico also works, as it is outside the scope of U.S. corporate income tax for complex historical reasons);

More on:

4. Import the active ingredient into the United States at a high price.

The tech tax game has the effect of lowering overall U.S. exports—rather than exporting a lot of software to say France, U.S. firms end up exporting their software to their subsidiaries in low tax jurisdictions, which then effectively “re-exports” the software to the actual customers (or sells services based on software). Look it up if you want (see table 2.2)—the largest single export market for U.S. software is in fact Ireland, or it would be if the 2018 number wasn’t suppressed to protect confidential firm data.* The overall effect is a “missing export”—Apple registers in the balance of payments data as a contract manufacturer that exports from Ireland (after “importing” the assembled phone from China and adding a markup), rather than an exporter from the United States, Google as an Irish seller of advertising services and so on.

The pharma tax game by contrast raises U.S. imports.

Bigly.

There are also missing pharmaceutical exports. Firms generally prefer to avoid exporting active ingredients from the United States and paying U.S. tax and instead prefer to produce for the European market in Ireland and the Asian market in Singapore and book their “export” profits offshore.

But only using your Irish facility to produce for the European market would be leaving (tax) dollars on the table—as many firms produce in Ireland to sell back to the lucrative U.S. market.

This is all quite clear in the trade data.

After a $40 billion surge in imports following the passage of the Tax Cuts and Jobs Act, the U.S. trade deficit in pharmaceuticals now tops the U.S. trade surplus in aircraft.** And that likely would be the case even if Boeing was able to export the 737 Max. Imports of pharmaceuticals now are $150 billion—a sum that would rise to around $200 billion if the pharmaceuticals that the U.S. imports (in a tax sense) from the unincorporated U.S. territory of Puerto Rico were counted, as Puerto Rico functions as an offshore tax center too. (3001 to 3006 in HTS codes/ $37 billion in 2016)**

This isn’t a trade deficit that can be traced back to competition from low-wage labor. The countries that supply the bulk of U.S. pharmaceutical imports are known for their generous tax treatment of multinationals, not for low wage costs. The U.S trade deficit in pharmaceuticals comes essentially from Ireland, Switzerland and Singapore.

A serious U.S. tax reform should have increased the tax bill paid by the major pharmaceutical companies—after all, the majority of today’s high priced drugs can be traced back to insights that emerged from work funded by the U.S. National Institute of Health. And the economic “rents” on patent protected pharmaceuticals are the kind of thing that should be taxed (especially as pharmaceutical companies can essentially deduct their R&D investment from their tax).

Unfortunately, the Tax Cuts and Jobs Act was a step backwards. It not only provided generous tax treatment (through the low GILTI rate) for companies that had offshored their intellectual property and production in the past, it also provided new tax incentives to offshore jobs and production.

There are a set of provisions in the Tax Cuts and Jobs Act that have helped bring down the effective tax rate of the largest U.S. pharmaceutical companies.

- Imports of tangible goods have been exempted from the Base Erosion and Anti Abuse Tax (the BEAT). The BEAT was meant to function as a minimum tax on intra-company payments, so as to make it harder for a company to shift profits out of the United States. By exempting tangible goods bought from a firm’s subsidiary, the tax reform assured that the pharmaceutical companies that “bought” active pharmaceuticals from their Irish subsidiary wouldn’t be caught up in the BEAT.

- The low tax rate on the GILTI. Companies that successfully move their intangible income outside the United States are rewarded with the lowest tax rate in the system. A major pharmaceutical company that has placed much of its intellectual property in Bermuda has reported an effective tax rate of around 10 percent.

- The GILTI is not assessed on a country-by-country basis—so a firm that produces in Ireland and pays the Irish tax rate on its Irish profit can use its Irish taxes to reduce the amount it owes on its tax free Bermuda profit. This provision also effectively creates incentives for firms with lots of Bermuda profits to produce in high tax jurisdictions (like Germany) rather than in the United States, as German tax payments can be used to reduce your Global Intangibles Tax on your Bermuda profit, while taxes paid in the U.S. cannot offset your global intangibles liability.****

- Firms are given a tax deduction for increasing their tangible assets abroad—so a company that produces offshore using intellectual property that is located offshore will have a lower U.S. tax rate than a firm that produces onshore using intellectual property located offshore (if that didn’t run afoul of other provisions of the tax code).

As former Treasury Secretary Larry Summers has said, “All too often, corporations are able to make use of tax havens, differences in accounting treatment across jurisdictions, and other devices to reduce tax liabilities.”

So long as U.S. firms are willing to use these strategies to raise their after tax profits, they also ought to be willing to disclose how much they are paying in GILTI, FDII, and BEAT alongside their standard U.S. corporate tax payments (see Peter Eavis of the New York Times). I would go a step further—and require country-by-country disclosure of firms profits and taxes paid. Rebecca Kysar’s excellent testimony before the House Ways and Means Committee makes a similar point.

More generally, I hope addressing the “Ireland first” provisions of the U.S. tax code become a policy priority. There is no sound public policy reason why the United States should be encouraging, through the tax code, U.S. firms to do high-value added manufacturing in Ireland and similar jurisdictions.

* In 2017, Ireland accounted for about a quarter of total U.S. software exports, and in 2017 and 2018 Ireland accounted for a quarter of US exports of research and development services—go figure.

** If there is an innocent, non-tax related explanation for this surge I am all ears.

*** Puerto Rico imports a lot of pharmaceuticals from Ireland, so simply adding U.S. "imports" from Puerto Rico to total pharmaceutical imports likely double counts a bit. Welcome to the complexities of an island that is inside the U.S. customs union but outside the scope of U.S. corporate income tax.

**** Ireland’s Capital Allowance for Intangible Assets (CAII) has allowed many firms to achieve effective tax rates of under 3 percent on their Irish subsidiaries. Many U.S. firms operating in Ireland thus do owe GILTI even though Ireland’s headline rate is 12.5 percent. See the discussion of Apple's Green Jersey.

Online Store

Online Store