The Spotty International Tax Record of Big U.S. Technology Companies

There was a saying a few years back that the United States is the one country where you could “make your first million (or billion) before buying your first suit.”

Perhaps that saying should be changed to United States is “the one country where a company can get a stock market capitalization in the hundreds of billions, or even trillions, before paying much—if any—tax to the U.S. government.”

More on:

I am referring of course to Nvidia, which doesn’t appear to have paid any tax to the United States Treasury on net between 2016 and 2022.

Nvidia obviously did pay a decent amount of U.S. tax in 2023 as its profit rose and it reorganized its tax structure. Per its most recent 10-k disclosure, its intellectual property now sits in the U.S. for tax purposes and it thus pays the Foreign-Derived Intangible Income (FDII) tax on its foreign sales. It consequently now pays U.S. tax (at a relatively low rate of 13.125 percent) on its large international sales, and its 2024 tax liability should also be significant. Yet the absence of U.S. income tax payments before 2023 is also a reminder that some big U.S. companies don’t pay much (or any) tax in the United States.

To be sure, the post-Tax Cuts and Jobs Act (TCJA) landscape for the taxation of tech companies is more complicated than the landscape for big pharma. Some companies—Google/Alphabet and Facebook/Meta at end of 2019, Qualcomm and Nvidia more recently—have repatriated their previously offshored intellectual property and thus now do pay some U.S. tax on their offshore sales and profits.

However, several big companies (Apple, most prominently, but also Microsoft—as outlined in the reporting of Thomas Hubert of The Currency) and strategically important companies that control the choke points for advanced manufacturing (such as Applied Materials and Lam Research) book most of their profit abroad. The chip equipment manufacturers also appear to have offshored some production to strengthen the legal basis for booking the bulk of their profit abroad (and to get tax incentives from other governments).

There are thus two issues. Let’s call one the “Ireland” problem and the other the “Singapore” problem.

More on:

The “Ireland” Problem

The Irish problem is simple: firms like Apple increasingly pay the bulk of the income tax on their global tax in Ireland rather than the U.S. (or the jurisdictions that generate their sales). That is why Ireland now has so much corporate tax revenue that it is now setting up its own sovereign wealth fund (see page six of this report by the Irish Fiscal Advisory Council: “Corporation tax receipts have more than tripled in the past eight years and hit a record of €22.6 billion in 2022”).

To be clear, Apple does pay U.S. tax on the profits on its U.S. sales; the issue is how and where it is taxed on its international sales.

A revealing anecdote: Apple’s PR team once fact-checked me, claiming I was wrong to say that Apple doesn’t do anything “real” in Ireland. Apple does have an equipment testing business and a build-to-order operation for certain iMac computers in Ireland, as well as a large data centers and plenty of accountants. But the truth is that Apple clearly doesn’t do enough “real” operating in Ireland to justify booking 60 percent of its global income in Ireland.

A typical Apple device has a design and software that comes mostly from the U.S., chips mostly from Taiwan, and the rest of the hardware is mostly from China, with final assembly also primarily done in China (with a bit now done in India—but only a little bit).

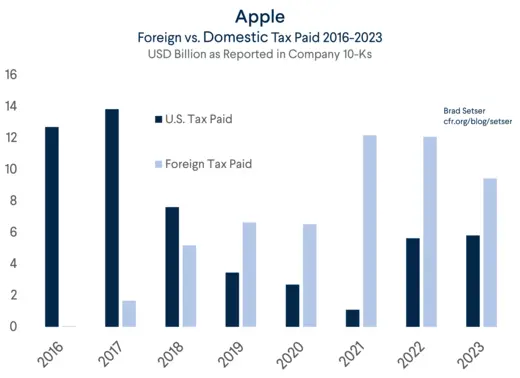

As a result of booking the bulk of its global income in Ireland, Apple consistently pays more income tax outside the U.S. than inside the United States. This has real consequences for the U.S. “fisc,” as Apple earns massive sums of money abroad. More, in fact, than the top six U.S. pharmaceutical companies combined.

That foreign profit is now essentially untaxed in the U.S.

We actually know a lot about Apple’s post-2014 tax structure.

In 2015, its Irish subsidiary bought its Jersey subsidiary for a reported (notional) price of around €200 billion (for detective work, see Seamus Coffey). It did so with money notionally borrowed from another Apple subsidiary. As a result of these tax moves, Apple became an Irish tax resident (and an Irish balance of payments resident, and a major source of Ireland’s reported GDP).

But Apple initially didn’t pay much Irish tax. It could depreciate the notional cost of buying Apple Jersey from the profit of Apple Ireland (so-called capital allowances). To make it a bit more concrete, $225 billion depreciated over 10 years is a deduction of about $22.5 billion a year, which more or less maps to the disclosed data. Apple could also deduct the interest it notionally paid to finance the cost of this intracompany transaction from its Irish profits.

The net result was initially a very low-income tax liability on its Irish profit (so low that Ireland tightened the rules).

But the depreciation allowance was a fixed dollar sum, and over time, Apple’s Irish profit increased (non-U.S. profits are now over $60 billion), and thus Apple’s Irish tax liability increased. It now likely pays $4-5 billion a year to Ireland (compared to $7-8 billion to the U.S.). After the Tax Cuts and Jobs Act, Apple has consistently started paying more tax outside the U.S. than it does inside the United States.

Such profit shifting (thought a standard research and development cost-share) perfectly legal by the way. In fact, the TCJA encouraged the maintenance of this structure, as Apple’s residual U.S. tax liability was set at 10.5 percent minus 80 percent of its tax paid abroad. More tax payments in Ireland thus didn’t change Apple’s total tax burden significantly, they just reduced Apple’s U.S. taxes paid.

Apple is far from alone here. Microsoft also Irish-shored a large share of its global IP (IBM and Oracle—and no doubt others—did too; Alphabet/Google and Facebook/Meta, by contrast, U.S.-shored their Caribbean IP at the end of 2019).

In fact, the $100 billion of offshored (and largely Irish) profit of Apple and Microsoft is a large share of the $400 billion or so that U.S. companies now report earnings in low-tax jurisdictions.

The underlying facts aren’t really subject to dispute; the basic fact pattern is public. Irish scholars and journalists like Seamus Coffey and Thomas Hubert have come to similar conclusions.

The enormous pool of profit shifted abroad by just two U.S. firms, Apple and Microsoft, reflects the reality is that the big, offshored pools of profit are very concentrated. Others, of course, play the same games (take a look at Hanesbrands, for example), but not on the same scale. Increasing U.S. corporate tax revenue thus comes down to finding ways to tax a relatively small number of firms, typically technology and pharmaceutical firms, more effectively. There is no point in pretending otherwise.

To be sure, Apple and Microsoft pay U.S. tax on profits from their U.S. sales—their tax structure differs from that of “Big Pharma”. They just aren’t paying much tax in the U.S. on their foreign sales, and in fact look to be paying more tax on their foreign sales in Ireland rather than the U.S.

The “Singapore” Problem

Singapore, while less well-documented, is another center of corporate tax avoidance. It has played a particularly important role in parts of the semiconductor business. Tax concessions granted for domestic manufacturing also seem to be used to shelter broader intellectual property profits.

There isn’t as much on the public record, so I need to rely a bit more on inference.

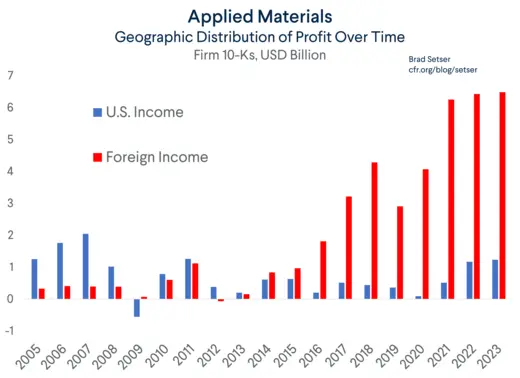

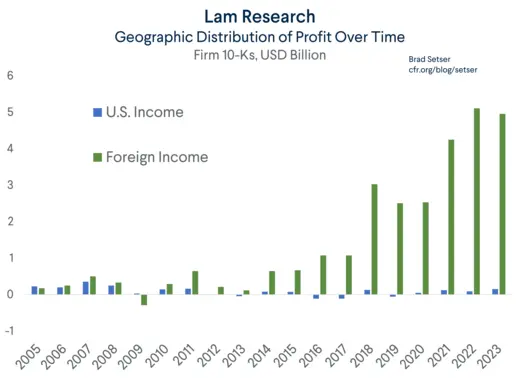

But in some key sectors, the basic fact pattern is clear. For example, over the last twenty years, two of the three major U.S. semiconductor equipment manufacturers have gone from reporting the bulk of their global profit in the U.S. and paying the bulk of their global tax to the U.S. to reporting that they earn their global profit outside the U.S. and, consequently, paying very little tax in the U.S.

Consider the reported foreign and domestic income of Applied Materials, an important supplier of semiconductor manufacturing equipment to global chip makers.

Over this same period, Applied Materials started manufacturing in Singapore (As stated on its website: “Singapore Manufacturing was established in 2010 as a worldwide hub for semiconductor equipment operations and is Applied’s largest manufacturing facility outside the United States... ”) and Malaysia, and as part of its incentives package with the government of Singapore, pays a very low tax rate in Singapore (below Singapore’s headline tax rate of 17 percent). Applied Materials’ 2023 10-K is crystal clear on this, as the tax arrangement is subject to renewal.

Lam Research shows a similar pattern, though it relies on tax incentives from Malaysia.* It has offshored most of its profit and, in the process, offshored a significant share of its manufacturing (As stated on its website: “We have teams around the world making that impact possible, including at our latest and largest site in Malaysia. This state-of-the-art new manufacturing site in Penang’s Batu Kawan was opened in August 2021 and is the largest in our network.”)

Most now recognizes the strategic importance of chips, and making the equipment used in manufacturing chips is the kind of high-tech strategic industry the U.S. should want to retain.

Yet the tax code appears to have created incentives to offshore the production of key components. The firms will say that they moved production to Southeast Asia to be closer to their customers, but I suspect that isn’t the full story.

Point being, the U.S. is currently bleeding tax revenue to Ireland, Singapore, and to a lesser extent, countries like Malaysia. It also appears to be losing key (and generally well-paid) manufacturing jobs in the process.** The (significant) tax policy changes in the TCJA unfortunately did not stymie the incentive to offshore a large share of profits generated by American technology companies.

But there is more heterogeneity in tax structure here. Some firms did use the low FDII tax rate and onshored. Others Irish-shored and/or Singapore-shored. Yet there should be no doubt that the U.S. is currently losing significant tax revenue. The surge in Irish tax collection from Apple, Microsoft, and Pfizer has largely come at the expense of the U.S.—Apple now pays more tax outside the U.S. than inside the United States.

The firms covered in my previous post on pharmaceutical tax avoidance have over $60 billion in foreign profits. Apple and Microsoft have over $100 billion. Applied Materials and LAM Research over $10 billion. There is real money to be raised by taxing these profits in the United States—and making a determined effort to reclaim the U.S. corporate tax base from countries like Ireland and Singapore.

* Lam Research 2023 10-K: “Effective from fiscal year 2022, the Company has a 15-year tax incentive ruling in Malaysia for one of its foreign subsidiaries. The statutory tax rate in Malaysia is 24%. The tax incentive provides exemptions on foreign income earned and is contingent upon meeting certain conditions.”

** Before Qualcomm checked a box and repatriated its previously offshored intellectual property, it appears to have relied on a Singapore and British Virgin Island-based tax structure. Applied Materials is far from alone in benefitting from generous tax incentives that bring the effective tax rate of international companies operating in Singapore well below Singapore’s headline corporate tax rate of 17 percent.

Online Store

Online Store