Revival of Credit?

More on:

Note: This is a guest post by Paul Swartz. Again, I appreciate Brad giving me the opportunity to fill in while he is on vacation.

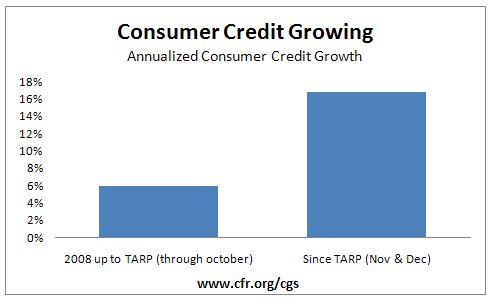

A recent congressional hearing focused on where the money from the first part of the TARP went. Some representatives chose to communicate the challenges that their constituents faced in were having getting credit and inquire whether the banks were extending credit. As shown on the Center for Geoeconomics Studies homepage, banks were contracting home mortgage credit in the third quarter. Given that the first TARP funds were distributed in late October (well into the fourth quarter) the latest Flow of Funds data leaves us to wonder whether the banks are extending credit after the first step of recapitalization or not.

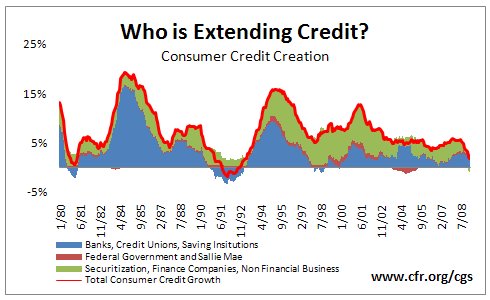

The Federal Reserve’s G19 Consumer Credit Report provides a credit picture on a timelier (monthly) basis. On a year over year basis consumer credit is growing. Banks are carrying this segment, making up for the securitization sector’s credit contraction (note: government lending plays a trivial role in this sector). It is interesting to note that, up until now, securitization has been more consistent (i.e. it has not been the cause of total growth volatility) than the banks (look at 81 and 90).

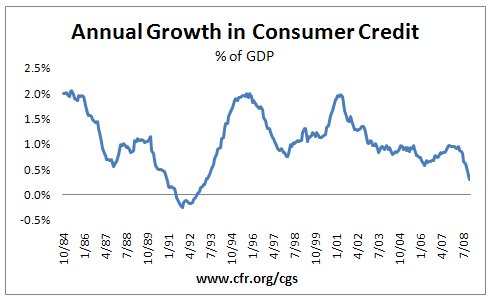

As a percentage of GDP, the consumer credit is much smaller than the mortgage market. The home mortgage credit market grew (excluding the boom) by around 4% of GDP per year while consumer credit market growth oscillated around 1% of GDP.

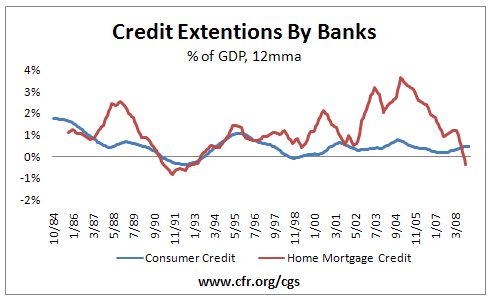

Are consumer and home mortgage credit extension connected enough for one to be a window into the other? If one looks only at the banking sector (banks, credit unions, and saving institutions), the year over year growth rates (as a % of GDP) for the two sectors are 35% correlated. This is illustrated in the chart below (I’ve smoothed the two series to 12 month moving averages as to make it easier to see). Fairly Rough.

But, if you are willing to take the consumer credit as a forward-looking indicator for the home mortgage credit, it looks somewhat positive. Maybe TARP I did do something but then again it has only been two months.

More on:

Online Store

Online Store