Central banks are still buying large quantities of Treasuries

More on:

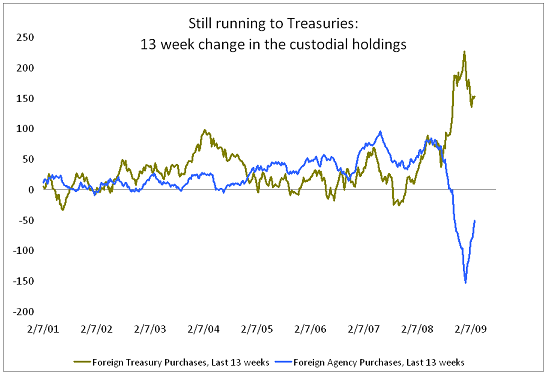

There has been a lot of chatter recently about the risk that foreign central banks would lose their appetite for Treasuries just as the US stepped up its issuance. The Fed’s custodial data, though, isn’t sending any warning signals. The CFR’s Paul Swartz calculated the 13 week (think 3 month) increase in central banks’ custodial holdings at the New York Fed.

Central bank purchases are down a bit from their December high (at their peak, central banks added more than $200b to their Treasury portfolio during a 13 week period) but remain very, very strong. $150 billion over 13 weeks (3 months) is a big number. Central bank purchases in the first quarter of 2009, for example, look to exceed central bank purchases in the first quarter of 2004. And that was when Japan was investing what then was considered a huge sum in the Treasury market.

Strong demand for Treasuries now is in some sense a surprise -- as central banks aren’t adding to their reserves at the same pace they once did and thus have less to invest. Central banks were almost certainly net sellers of reserves in the fourth quarter. And in the first quarter the only major potential source of reserve growth is China. The oil exporters are selling their reserves to offset the impact of low oil prices (and to finance domestic bailouts; think of the UAE’s bailout of Dubai).

The rise in Treasury holdings in the last 13 weeks isn’t simply a function of Agency sales either. Agency sales of $50b offset only a third of the $150b rise in Treasuries; the net increase in central bank custodial holdings was still close to $100 billion.

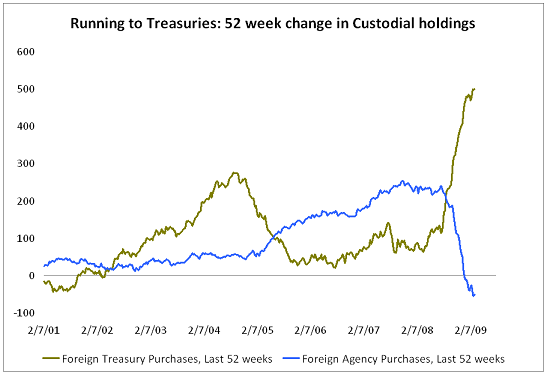

The 52 week change in the Fed’s custodial holdings of Treasuries is still running at around $500 billion -- and the total increase, net of Agency sales, is around $450 billion. The US current account deficit over this period will only be a bit larger.

Unless reserve growth resumes -- and it may well, as it is quite likely that a host of emerging markets will conclude from this crisis that they need more not fewer reserves -- it is hard to see how that pace can be sustained. Unless, of course, central banks shift in mass out of Agencies and into Treasuries.

p.s. The growth in the Fed’s custodial holdings of Agencies from 2005 to mid 2008 reflects, above all, the growth in the Agency portfolios of China and Russia. We more or less know this from the survey data. Japan and Korea also contributed as both were reallocation a fraction of their reserve portfolio from Treasuries to Agencies during this period. But the big buyer of short-term Agencies during this period was Russia and the big buyer of long-term Agencies (including Agency MBS) then was China.

More on:

Online Store

Online Store