Obama’s Budget Strategy

More on:

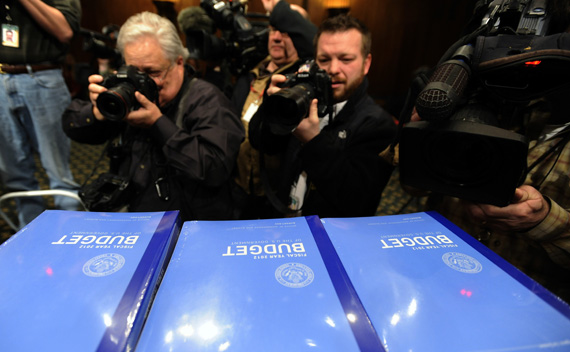

President Obama unveiled his FY12 federal budget proposal on Monday. Several of my CFR colleagues have weighed in with their assessments of what the president’s budget means for the economy, American competitiveness, global health, defense, and efforts to mitigate climate change. These are all smart people with deep insights, so I won’t cover the same terrain.

I am more interested right now in the politics of the president’s proposal. The early reviews have not been kind. The Washington Post says “The President Punted.” John Dickerson at Slate.com speculates that Obama’s budget proposal “is so timid, he must be working on a smarter plan we don’t know about.” The Wall Street Journal says Obama “did a Cee Lo Green (‘Forget You,’ as cleaned up for the Grammys) to the voter mandate in November to control spending.”

(I confess. I have no idea who Cee Lo Green is. I can name the starting line-up of the 1967 Boston Red Sox, though.)

The president is getting bad press because his budget fails to grapple head on with the federal government’s budget woes. The New York Times, in an editorial that strained to find positive news in the budget, unintentionally highlighted its major flaw:

Real deficit reduction will require grappling with rising health care costs and an aging population, which means reforms in Medicare, Medicaid and Social Security, as well as tax increases to bring revenues in line with obligations.Mr. Obama’s budget does not directly address those big issues.

The president understandably touts the fact that his budget would save $1.1 trillion over the next decade. But it would also add another $7.2 trillion to the national debt. Not good. And those two numbers rest on rosy assumptions about how the economy will do in coming years.

Political insiders say that the president’s proposal is savvy politics. (No one is saying this to me personally. I hang around with policy wonks, an entirely different breed. But it is what Politico, Slate, and the New York Times are saying. The calculation is that Obama has set a trap for Republicans. By refusing to offer his own plan for fixing what ails us, he has put the ball in the Republicans’ court. They presumably will offer ideas that will repel the average voter and allow Obama to ride to the rescue.

I’m normally sympathetic to arguments from savvy political strategists. I know that we policy wonks often bring a naïve, technocratic mindset to politics. (Academics, which I once was, are even worse.) Good ideas alone are seldom enough. Unless they are encased in an armor of hard-nosed political calculations, even the best ideas end up on the ash heap of history.

Here, however, I think the savvy insiders have it wrong. One problem is that the “trap mentality” assumes that Republicans don’t know what awaits them. But they do. How can they not? They read newspapers and blogs too.

And so GOP strategists will work to counter the trap. They have already played card A—criticizing the president for failing to lead. Rep. Paul Ryan put the point bluntly to OMB director Jacob Lew at a House Budget Committee meeting on Tuesday: “Why did you duck?” If the Republicans succeed in convincing the public that Obama is ducking tough issues, the White House could quickly find itself chasing the public debate rather than leading it.

Sure, divisions within the Republican rank-and-file might force GOP leaders to walk off a political cliff and save the White House. Tea Partiers have strong views that likely will alienate the broader public. But it is never wise to base your strategy on the assumption that your opponent will play his hand badly.

Moreover, the GOP has a point. Presidents are supposed to lead. When they duck major issues—and a $1.6 trillion deficit is a major issue—policy reform generally either goes nowhere or it goes badly. Getting the public to go along with significant changes in entitlement programs will take considerable effort—one that is best led from the White House bully pulpit. The public might know in the abstract that the federal budget deficit must be closed. But they don’t know in their bones why it is important to do so or what steps are necessary, fair, or wise.

That’s why, unlike John Dickerson, I don’t hope that Obama has a secret plan up his sleeve to cut a backroom deal for entitlement reform. Any significant deal of this sort will fall apart once it is made public. No public support has been built for it. (Ironically, John Dickerson makes the best case that the public needs to be convinced that deficits and debts matter.)

There is still another problem with the trap strategy. As John Cassidy points out, Obama is betting that the bond market will give him time to pull one over on the Republicans. That is, the White House is assuming that interest rates will stay low for years to come, making it possible for the United States to borrow the trillions it needs to continue living beyond its mean.

It’s not a totally unreasonable bet, and not just because Dick Cheney assured us that deficits—and by implication, debts—don’t matter. Interest rates are at historical lows right now, always good news for borrowers. A major reason it is cheap to borrow is that China, Russia, the Gulf States, and a few other countries are sitting on piles of cash. U.S. Treasury bonds are a safe and reliable place to park that cash.

Until, of course, they no longer look safe and reliable. If, or when, investors decide they would rather put their money elsewhere, interest rates will jump. That means higher repayments on all that money Uncle Sam has borrowed, making even more red ink gush out the federal government’s coffers. That will mean even deeper budget cuts will be needed to put the federal budget back in balance. Higher interest rates will also slow down economic growth and possibly even send the economy into a tailspin. That would further widen the federal budget deficit. A vicious cycle.

We have already seen a version of this movie in Greece, Ireland, Spain, and several other European countries. When investors decide they don’t want to buy your bonds, you are, as the elder President Bush used to say, in deep kimchi.

I know, I know. The United States is not Spain, let alone Greece. Being the world’s largest economy and providing its de facto reserve currency provides special benefits. But being important does not by itself suspend the laws of economics.

When will we reach the tipping point that will lead the so-called bond vigilantes to strike? Therein lies the rub. No one knows. Interest rates have been creeping up in recent months. That could be due to a slowly strengthening economy. Or it could be the first sign that investor attitudes toward the U.S. fiscal position are shifting. We will know for sure in thirty-six months, but by then it could be too late.

So we sit and wait. All things budgetary might turn golden for Obama. Sometimes you can draw to an inside straight. Republicans may give him a political victory. The bond market may wait patiently for Uncle Sam to put his fiscal house in order. But never confuse being lucky with being wise.

More on:

Online Store

Online Store